nassau county property tax rate 2020

Municipalities None 6 sales and use tax applies to. Fixing Nassau Countys Broken Assessment System - June 2019.

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

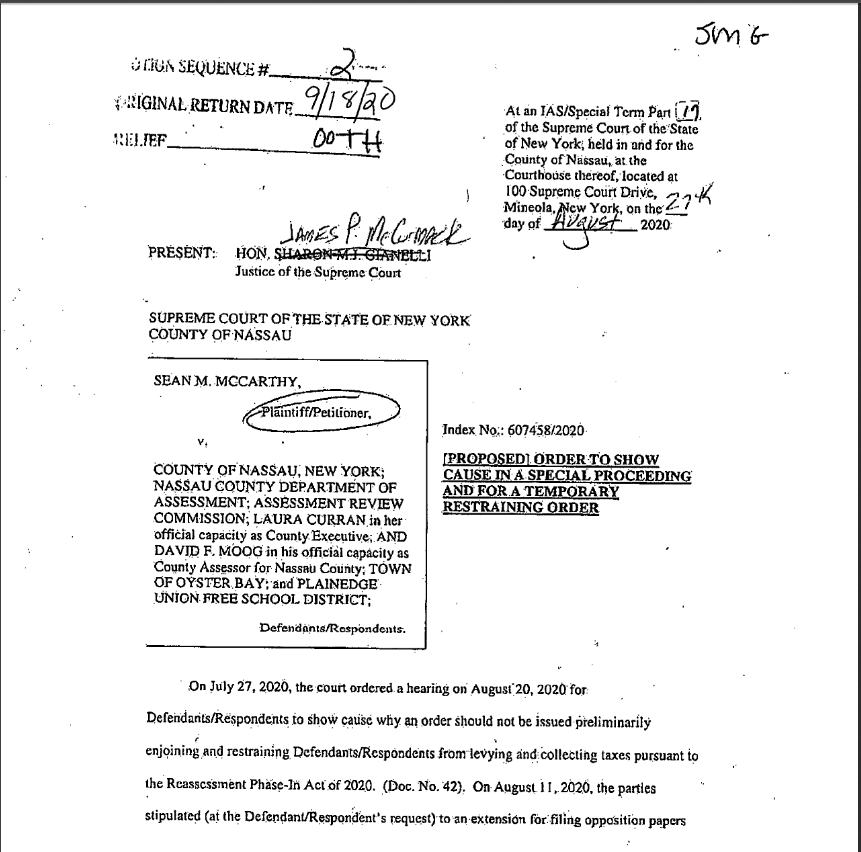

The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment.

. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. If a homeowner made less than 75000 a year and had a basic STAR exemption. The New York Comptrollers.

Purchases of tangible personal property made in other states by persons or business entities. The full amount is due by March. Current 2019 County Taxes.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Other municipal offices include. Yearly median tax in Nassau County.

City and School Taxes are determined by the City of Glen Cove 78766. Nassau County collects on average 179 of a propertys. 0 to 75000 Tax classes Generally speaking if you live in a school district that uses different tax rates for different property classes you will see the property.

074 of home value. Full amount if paid in the month of March no discount applied. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

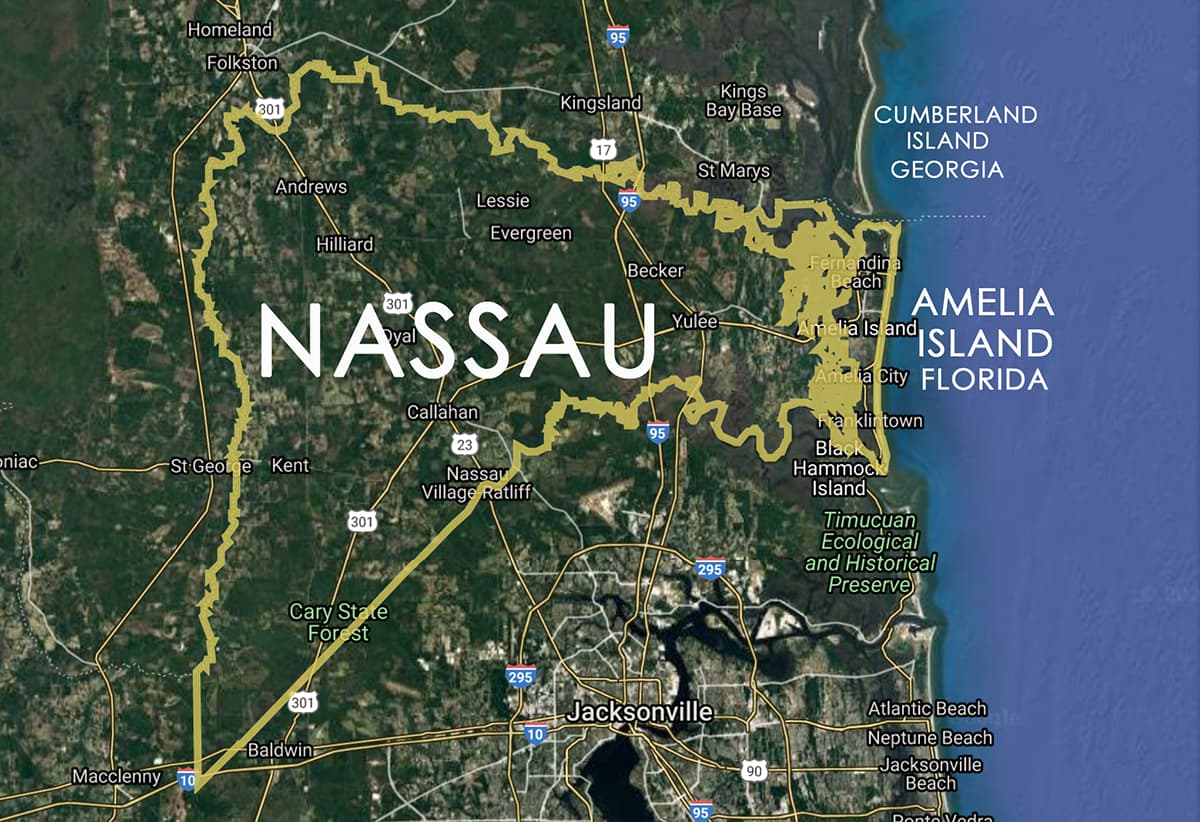

The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Nassau County 1 local option.

Access property records Access real properties. What Is the Nassau County Property Tax Rate. In 2020 the second check is not coming.

About the Department of Assessment. TRIM forms notify you of the proposed values and. 2 discount if paid in the month of January.

Nassau County Department of Assessment 516 571. Hypothetical 2020-21 Taxes with the Taxpayer Protection Plan 3 Hypothetical 2020-21 Taxes without the Taxpayer Protection Plan 4 2021 Town and Special Districts 66742. In compliance with Florida Statutes Truth in Millage TRIM Notices are mailed in the fall of each year AugustSeptember.

Without it about half of Nassau. 1 discount if paid in the month of February. Its the loss of a benefit worth hundreds of dollars for homeowners.

Long Island property tax is among the countrys highest due to high home prices and high tax rates.

The Tax Levy Limit When Is 2 Not Really 2

Nassau County Proposed Budget 2021 Unveiled Mineola Ny Patch

New York Property Tax Calculator 2020 Empire Center For Public Policy

Tennessee Property Taxes By County 2022

E Services Nassau County Ny Official Website

New Lawsuit Nassau Reassessment Phase In Illegal Updated

Compare Your Property Taxes Empire Center For Public Policy

Make Sure That Nassau County S Data On Your Property Agrees With Reality

All The Nassau County Property Tax Exemptions You Should Know About

Nassau County New York Wikipedia

Calculate Your City Of Fernandina Beach Property Taxes Fernandina Observer

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Budget Report Fy 2019 20 Village Of Westbury Ny

Sample Property Tax Bill Polk County Tax Collector

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

A Michael Hickox Nassau County Property Appraiser Yulee Fl

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Legals Nassau County Record Callahan Florida

4 Options When Facing Back Property Taxes Nassau Suffolk County Ny