straight life annuity settlement option

A pure life annuity. A life annuity provides a larger amount of monthly income than if a lump sum was invested and only the interest earnings were taken as retirement income.

When Can You Cash Out An Annuity Getting Money From An Annuity

Also known as a straight-life or life-only annuity a.

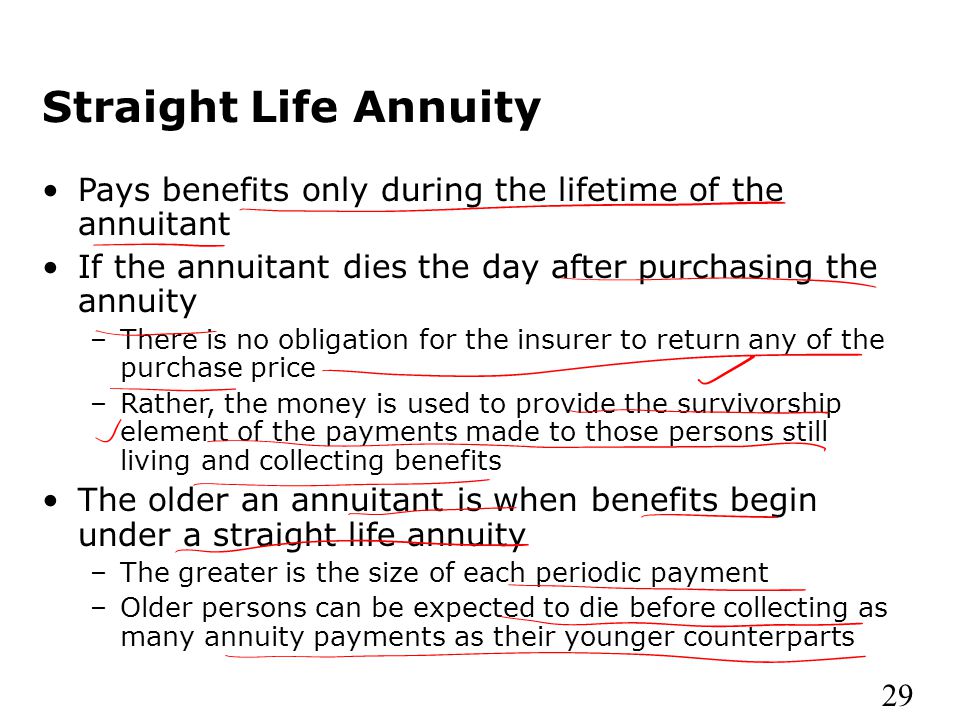

. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. The straight life annuity option provides the largest amount of guaranteed for life income of any retirement plan choice. Straight life annuities do.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. The straight life annuity option. While a straight life annuity is tied to your lifespan period certain annuities pay out over a set amount of time.

Learn what a pure life annuity is and how it works including information about settlement options pure life annuity taxation and who is a good candidate. Under a straight life annuity if the annuitant dies before the principal amount is paid out the beneficiary will receive Nothing. Refund straight life is one of the annuity settlement options where your beneficiary gets the proceeds and the interest earned in the event that.

If a settlement option. Another option could be a period certain annuity. Payments are made until both named individuals of the annuity owner and beneficiary usually a spouse.

If an annuitant selects the straight life annuity settlement option in order to receive all of the money out. Annuity Settlement Options - One of the unique features of an annuity is the opportunity to elect a settlement option and set up a dependable stream of income. If your death occurs before receiving 180 monthly payments the ASRS will pay the remaining.

The payments will cease. Of the contract it would be necessary to. The straight life annuity.

Because of this straight life annuity products are usually. If an annuitant selects the straight life annuity settlement option in order to receive all of the money out of the contract it would be necessary to A Live at least to his life expectancy. This type of annuity is called a straight life annuity A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live.

If an annuitant selects straight life annuity settlement option in order to receive all of the money the owner needs to. After 180 payments your benefit is automatically adjusted to your Straight Life Annuity amount. The form of life annuity which pays.

Joint And Survivor Annuity. A straight life annuity completely stops payments upon death unlike other annuities. Live at least to his life expectancy.

:max_bytes(150000):strip_icc()/Term-a-annuity_Final-22818c662b274f2c82716dd2184f06c9.png)

Guide To Annuities What They Are Types And How They Work

Joint And Survivor Annuity The Benefits And Disadvantages

What Is A Straight Life Retirement Annuity

Settlement Options E Commerce Lecture Slides Slides Fundamentals Of E Commerce Docsity

Solved 14 Which Of The Following Statements About Life Chegg Com

Solved 14 Which Of The Following Statements About Life Chegg Com

Is An Annuity Suitable For My Financial Plan

First Great West Life 38 Annuity Insurance Company

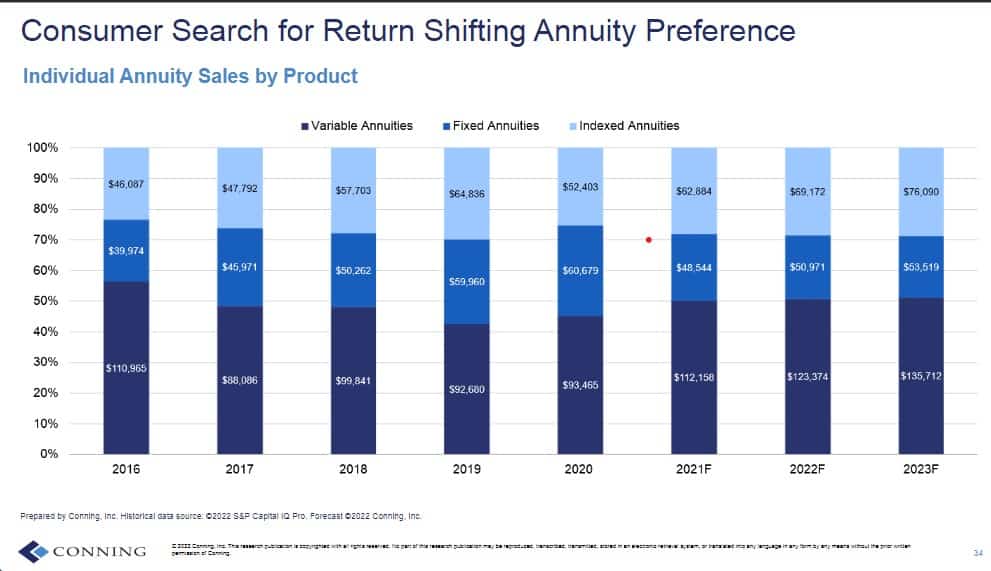

Strongest Life Annuity Market In 20 Years Conning Says Insurancenewsnet

Straight Life Annuity Providing Peace Of Mind In Your Retirement

What Is A Straight Life Annuity Retirement Watch

Annuity Payout Options Payment Types Retireguide Com

Learn The Basics Of Pure Life Annuities Trusted Choice

Learn The Basics Of Pure Life Annuities Trusted Choice

After A Blistering 2022 In Life Annuity Sales Expect A Cooler 2023 S P Says Insurancenewsnet

Annuitization What Is It And How Does It Work 2022

Annuities And Individual Retirement Accounts Ppt Video Online Download